Already a member? Click here.

Discover a Better Way to

Manage Your Money

From home to work, and on the go, Arizona Financial is with you every step of the way!

Cards That Do Good

Support first responders, Arizona Humane Society, and other local charities with every swipe.

Mobile Banking

Manage accounts, transfer money, pay bills and redeem your Cash Back Offers.

Loan Possibilities

Choose from a variety of loans — mortgage, auto, boat, home equity, motorcycle, RV, ATVs.

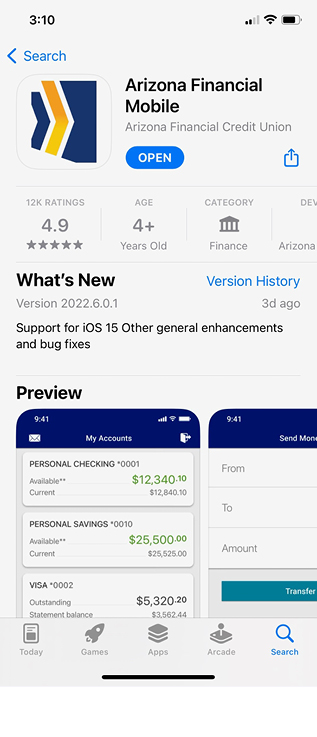

Mobile Banking

-

Manage Your Money

Check balances, make transfers, pay bills, deposit checks, sign up for balance alerts and more.

-

Payments and Transfers

Pay bills with free Bill Pay, transfer money between eligible accounts, and pay other people by text or email with Zelle®.

-

Loan Services

Submit your loan application and accept your pre-approved offers1 right on your phone! You can also sign up for Skip A Payment (if eligible).

1 On approved credit. All members may not qualify.

-

Manage Cash Back Rewards

Track and redeem your debit card cash back offers. Select your favorite retailers and enjoy cash back on purchases!

Explore Careers at Arizona Financial.

Best. Job. Ever.

-

Our Community Impact

You'll be part of a team that gets involved and gives back to our local communities in a big way.

-

Culture

Employee experience is the pulse that keeps us moving forward. Fun, excitement and appreciation are key culture attributes.

-

Benefits Package

Beyond the basics. At Arizona Financial you'll receive up to 5K in tuition assistance, 10K of life insurance, over 3 weeks of paid vacation, and of course all of the "bank holidays" paid as well.

*APY – Annual Percentage Yield. Minimum opening balance and minimum to earn dividends is $1,000 for all Certificates. Dividends accrue from date of deposit and are compounded and credited monthly based on the average daily balance. Withdrawal of dividends prior to maturity will reduce your earnings. Penalty amounts may exceed earnings. Fees may reduce earnings. Certificates that renew automatically will receive the rate in effect on the date of renewal. There is a 10-day grace period at maturity. Non-renewals do not earn dividends after maturity. You have agreed to leave the principal of this account on deposit for the full term stated on your Certificate deposit receipt. If all or part of the principal is withdrawn before the maturity date, the Credit Union may charge you a penalty.

Financial Resources

Auto Loan Calculator

How much car can you afford? Explore estimated monthly payments using different loan amounts and interest rates to find an amount that works for you and your budget.

CalculateMember Resource Center

Whether you're new to Arizona Financial or a current member, visit the Resource Center for helpful info managing your accounts, activating your Visa® cards and making payments.

Take Me ThereMistakes First-Time Home Buyers Make

Before you start looking for your first home, take a look at these common mistakes first-time homebuyers make.

Read MoreSkip Your Loan Payment

Free up some cash anytime of the year with our Skip-A-Payment program. You may be eligible to skip your loan or credit card payment once every 12 months.

Learn MoreAll You Need To Know About P2P Payments

These days there are so many ways to pay besides cash or card. Peer-to-peer (P2P) money transfer services make it super-convenient to send money, but beware of some potential pitfalls.

Read MoreCompare Mortgage Payments

Explore the possibilities with our mortgage calculator and see how affordable homeownership can be! Try a few different rates and terms to see what might work for your budget.

Calculate