Having a child can be a shock to your system. Not only does it take a lot emotionally and physically to give birth to and raise a child, but it takes a hit on the hopefully well-oiled financial system you have (correction: had) in place. There are so many expenses that come with having a child (e.g. diapers, clothes, food, doctor’s visits), not to mention preparing for a child, let’s just focus on fitting the largest expense of all into your spending plan mix: childcare.

In 2016, the average cost of childcare in Arizona ranged from $9,000 to $12,000 for the year, depending on whether the center was accredited or not. That’s almost $1,000 per month for full-time care for one child. If you weren’t planning on shelling out the equivalent to a mortgage payment every month, take a look at how one family adjusted their spending plan to afford daycare for their new baby.

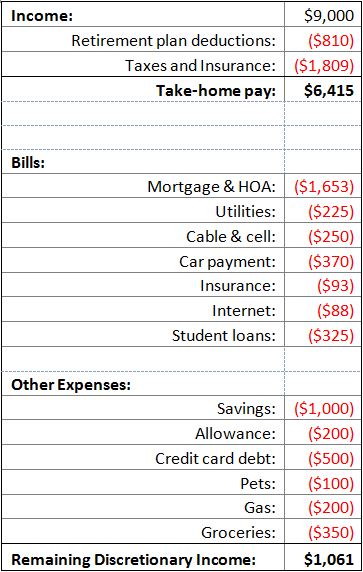

To start out, Khara and Steve sat down and reviewed their current monthly spending plan, to make sure it was accurate. Here’s what it looked like before baby:

On first glance, it looks like they could pull the money for daycare from discretionary income. However, that would give them almost no money to account for costs of gifts, replacing worn down clothes, personal hygiene, occasional date nights and all of the other random expenses that seem to pop up.

So how do they fit childcare into their budget without losing all of their discretionary income?

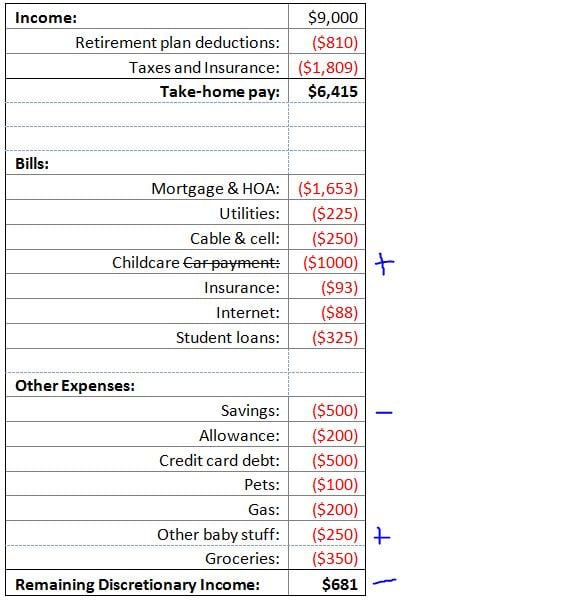

First, they noticed their car was almost paid off – so they pulled the last few payments (about $2000) from their savings account to get rid of that payment. Then, they cut down on eating out to once every-other-week instead of two-to-three meals each week and saved another $500 or so in unnecessary food expenses. This generated $870 per month that the couple could use to reduce their credit card debt in the months leading up to the baby – and use for childcare once the baby was born and they both had to return to work.

Here’s what their budget looks like now:

While they definitely have less discretionary income than they did before and had to reduce their regular savings contributions, they’re working steadily on paying down their credit card debt by the end of the year. Once that’s paid off? They plan on maintaining their current lifestyle and putting the money towards savings.