With student loan debt in the U.S. at $1.6 trillion dollars and the average student owing more than $37,000 by the time they leave school (many with multiple loans), it’s important to know the options on the best way to repay these loans.

Understanding Your Options

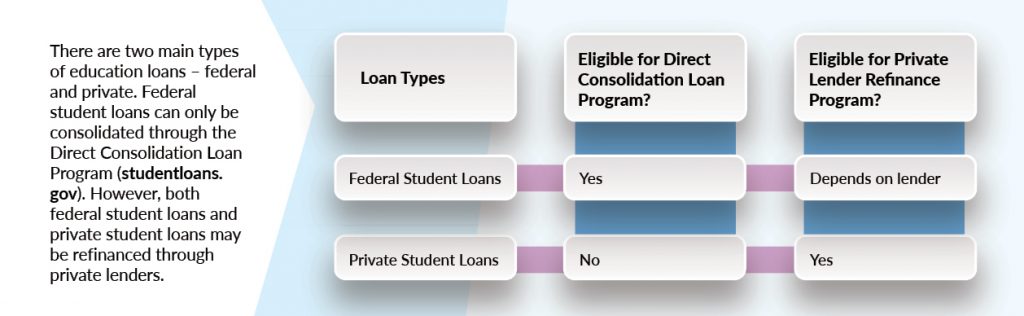

Here are seven things to think about when considering a Direct Consolidation Loan or refinancing through a private lender.

- Original loan benefits forfeited when consolidating

When federal student loans are included in a refinance with private student loans through a private lender, any benefits that came with the original federal student loans (e.g., loan forgiveness, payment deferment) are lost.

However, by consolidating federal student loans through the Direct Consolidation Loan Program many benefits are available to assist with repayment, deferment and other loan forgiveness programs not available through a private refinance program.

If you have both federal and private student loans, it’s sometimes better to consolidate the federal student loans through the Direct Consolidation Loan Program, getting the lowest monthly payments possible. You can then use the extra funds freed up to pay down any private student loans faster. - One loan, one payment, one lender

When consolidating your federal student loans or refinancing your student loans, it will result in one loan and one payment with one lender.

This will save you the hassle of keeping track of multiple payments and due dates. Making one student loan payment instead of multiple payments should reduce the likelihood of missing payments and going into delinquency (and the risk of negatively impacting your credit score). - Avoid delinquency or default

If you’re having trouble repaying your student loans, consolidating your federal student loans or refinancing your private loans may result in a lower monthly payment, making them more manageable. Be sure to use the calculator on the lender’s website to get an estimate of the monthly payment.

Defaulting on a federal student loan will hit your credit score and remains on your credit report for seven years. Also, federal student loans and most private student loans are not dischargeable through bankruptcy. - Lower interest rate … not always

The Direct Consolidation Loan Program calculates the new loan’s interest rate by taking the average weighted interest rate of all federal loans being consolidated and rounding it to the nearest one-eighth of one percent, and it is a fixed interest rate for the life of the loan.

So, if you have a mix of high balance, low interest rate federal loans and low balance, high interest rate federal loans, your new Direct Consolidation Loan may end up with a higher interest rate than you thought (and result in paying more interest over time). Be sure to use the calculator to determine your Direct Consolidation Loan’s interest rate.

For a private student loan refinance, the loan’s interest rate is dictated by the lender and is typically based on the applicant’s credit score and credit history. The lender often requires a cosigner depending on the applicant’s credit profile. Also, the interest rate on a private refinance loan can be fixed or variable. - Fees

There are no fees to consolidate federal loans with the Direct Consolidation Loan Program. There are also no prepayment penalties.

Private refinance lenders may charge a fee to refinance federal student loans and/or private student loans, and may charge prepayment penalties. - Lower payments, extended repayment terms

A Direct Consolidation Loan offers a variety of repayment terms, some which can extend the repayment terms from 10 years to 15, 20 or 30 years. This longer term can reduce the monthly payment, making it more affordable.

Before refinancing your federal loans with private loans, be sure to understand the repayment terms of the private refinance loan. - Repayment Plans

A Direct Consolidation Loan offers several repayment plans that may make it easier to repay: standard, extended, graduated (start low, increase every two years), and income-based. The borrower can switch repayment plans at any time, but that may result in paying more interest over time.

Some private refinance lenders do not offer a variety of repayment plans.

If you have multiple student loans, consolidating your federal loans through the Direct Consolidation Loan Program (studentloans.gov) or refinancing your private student loans could help lower your payments and make it easier to keep track of payment due dates so you don’t become delinquent. Just be sure to carefully read and understand the terms and conditions.

Sources:

www.debt.org/students/pros-and-cons-of-student-loan-consolidation/

www.finaid.org/loans/privateconsolidation.phtml

www.consumerfinance.gov/consumer-tools/student-loans/